Description

After completing this course, you will have a broad understanding of the industry, and you will have identified what you specifically need to develop further for your targeted company and role in the commercial real estate business.

300+ Bonus Job Interview Vocab Flash Cards Included

Course Summary

Module 1: Introduction to the Real Estate Business

In this module, you will:

-

Get a general overview of the composition and facets of the commercial real estate business

-

Understand the two main ways to make money in real estate

-

Gain an appreciation for how properties are valued through multiple frameworks

Details

In this module, you will learn about types of real estate, sources of capital, how capital is used to create value in real estate, investment objectives and methods, and get an introduction to the valuation of real estate.

- Size and scope of the U.S. commercial real estate market

- Commercial property type classes

- Types of real estate capital providers

- Sources of equity and debt

- Illustrative $10MM and $100MM transaction capital structure

- The two main ways to make money in real estate

- How capital is used to create value

- Dominant approaches for valuation of real estate

This is a slide presentation course with an associated multiple choice quiz. You will watch the video and, if you choose, complete the quiz and review the answers given when the quiz is automatically graded.

The video running time is 35 minutes. Watching all the video (replaying parts where desired) and completing the quiz and reviewing the answers will take approximately 45 to 55 minutes, depending on the individual.

Through the direct experience of REFM’s principals in commercial real estate transactions, and REFM’s ongoing consulting to industry practitioners across the U.S. over two decades, we have developed and have continually refined “The REFM Way” of teaching about real estate and financial modeling.

Corporate Training Clients

University Training Clients

To enhance your learning and help you to efficiently build a practical skill set, we:

- Always set the stage by providing the big picture first

- Speak in plain language and define industry terms on an ongoing basis

- Give you highly granular video chapter hyperlinks so you can find what you want quickly and easily.

Upon successful completion of this module, you will:

- Have gained a 30,000-foot view of the commercial real estate business

- Have learned the basics of how capital is used to create value in real estate

- Understand the rationale for the existence of multiple property valuation methods.

Includes

Lifetime online access to:

- An easily-navigated 35-minute video tutorial with playback controls up to 2x speed. Videos have captions available and are playable on any device including PC, Mac, phones and tablets.

- PDF file of the 37 slides presented in the video

- 10-question quiz (multiple-choice, automatically graded) and answer key.

Since 2009, top companies and educational institutions have trusted REFM to train thousands of their employees and students.

Clients Include

Clients Include

Amherst

ASB Capital Management

Barings

BentallGreenOak

BrightSpire

Brixmor

Brookfield

CapitalOne

CBRE Global Investors

CCRE

Centennial Bank

Citibank

ColonyNorthstar

Conrex

CPPIB

CRC Companies

CreditSuisse

Crescent Communities

Crow Holdings

DDG

DLA Piper

Greystar

GTIS Partners

Hodes Weill & Associates

Houlihan Lokey

Howard Hughes

Jamestown

JBG Smith

JPMorganChase

Kennedy Wilson

Link Logistics

LivCor

Lubert-Adler

Macys

Oxford Properties

Park Hill

Peterson Companies

PGIM

PN Hoffman

Prometheus

QuadReal

Related

Revantage

SEO

Skanska USA

Square Mile Capital

USAA Real Estate

Asset Living

CBRE Global Investors

Clark Enterprises

Comstock Homes

Conor Commercial

Crescent Communities

Federal City Property

Flournoy

Four Seasons

Grosvenor

GTIS Partners

Hines

Hoffman

Howard Hughes

HPET

Hunt Companies

Insight Property Group

Kettler

LaSalle Investment

MadisonMarquette

Markwood

Mesa Capital

Midway

Miller Valentine

Panoramic Interests

PEG Development

Renaissance Downtowns

Rockefeller Group

Skanska USA

Snavely Group

Trammell Crow Residential

Trion Properties

Vornado

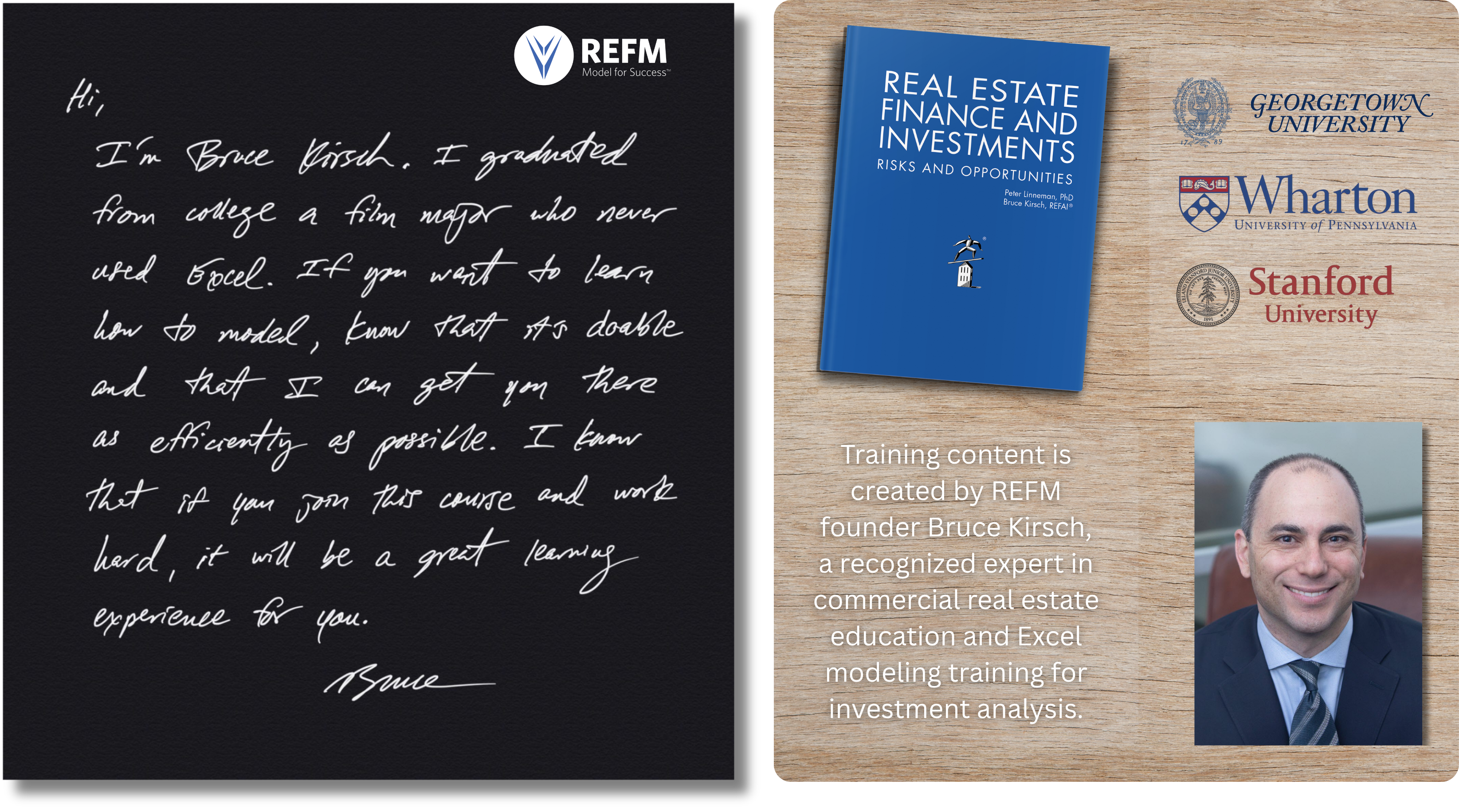

Meet Your Instructor

Sample Video

Video Chapter Markers

- Where to find the slides

- Agenda

- Overview

- Residential real estate introduction

- Office

- Commercial property type classes

- Multifamily

- Hotels & resorts

- Industrial

- Retail

- Other

- Types of real estate capital providers

- Sources of equity

- Sources of debt

- Illustrative $10 million capital structure

- Illustrative $100 million capital structure

- Two main ways to make money in real estate

- How capital is used to create value

- Acquisition of existing property

- Rehabilitation/repositioning

- Conversion of use

- Land entitlement

- Rezoning

- Ground-up development

- Investment objectives

- Executing on investment objectives

- Valuation of residential real estate

- Valuation of commercial real estate

- Method #1 – DCF

- Method #2 – Capitalization rates and comparable sales

- Method #3 – Replacement cost

- Triangulation

- Method #4 – Residual land valuation

Module 2: Identifying Risks and Opportunities in Commercial Real Estate

From this module, you will:

-

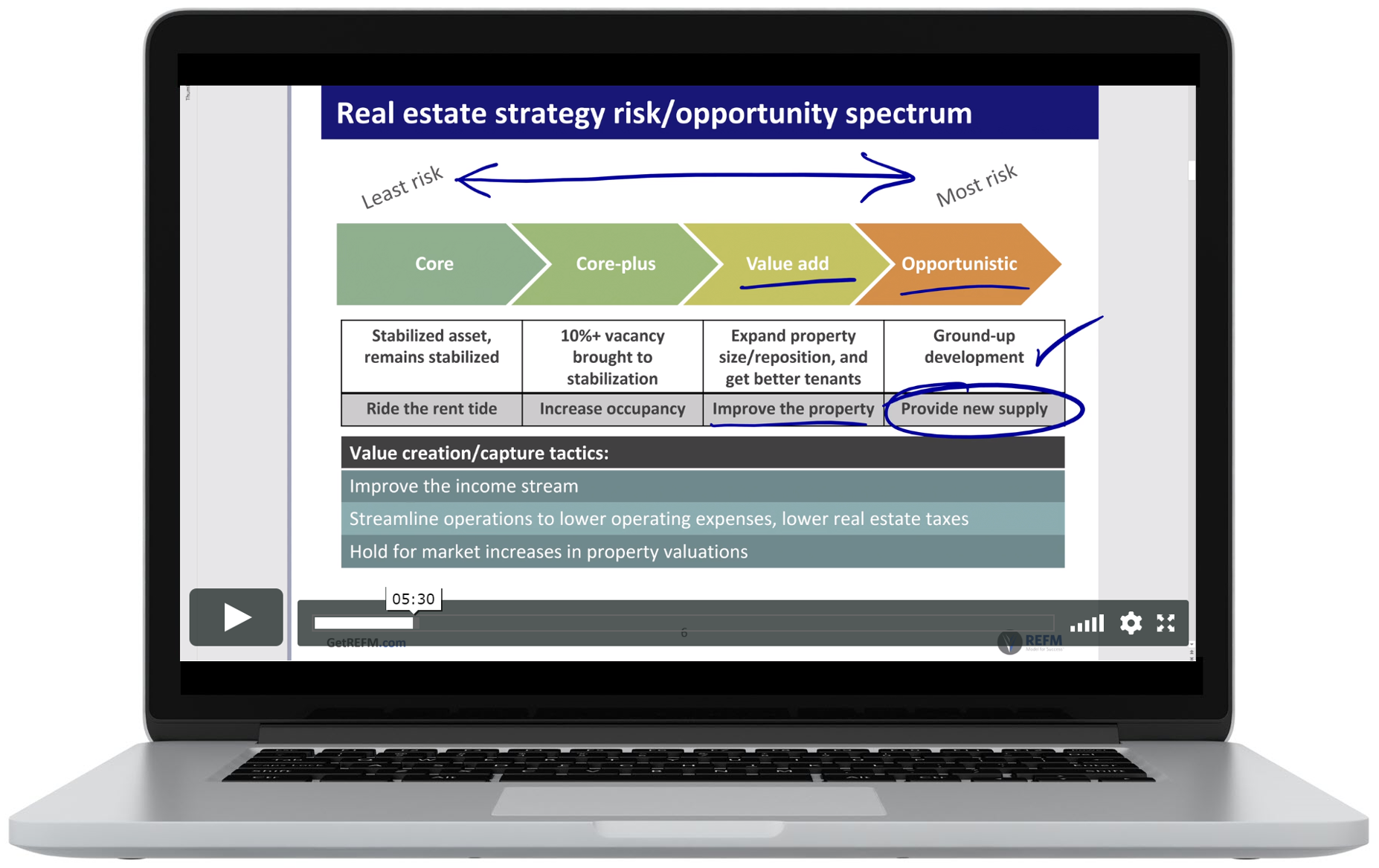

Understand the risk spectrum of commercial real estate investing

-

Be able to identify major risks and understand how professionals mitigate them

-

Grasp the real estate cycle’s contributions to the risk and opportunity equation

Details

In this module, you will learn about the commercial real estate risk/opportunity bargain and spectrum, identify the primary risks and whether they can be mitigated, understand the magnified risk in international investing, and learn about the biggest risks of all, including that of operating within the real estate cycle.

- How to lose money in real estate

- The spectrum of risk in CRE investing

- The tactics of risk mitigation

- Structuring commercial real estate leases to mitigate risk

- Risks common to all assets

- Risks unique to ground-up development

- Risks unique to investing across borders

- The real estate cycle

- Market crashes

This is a slide presentation course with an associated multiple choice quiz. You will watch the video and, if you choose, complete the quiz and review the answers given when the quiz is automatically graded.

The video running time is 40 minutes. Watching all the video (replaying parts where desired) and completing the quiz and reviewing the answers will take approximately 45 to 60 minutes, depending on the individual.

Upon successful completion of this module, you will:

- Have gained a holistic understanding of the ideas of risk and opportunity as they relate to commercial real estate investing domestically and internationally

- Have learned about risk mitigation tactics employed in practice in the business

- Have an appreciation for the reality that some risks must simply be accepted.

Includes

Lifetime online access to:

- An easily-navigated 40-minute video tutorial with captions available and playback controls up to 2x speed. Videos have captions available and are playable on any device including PC, Mac, phones and tablets.

- PDF file of the 33 slides presented in the video

- 10-question quiz (multiple-choice, automatically graded) and answer key.

Video Chapter Markers

- Agenda

- Overview

- No losing money in real estate

- Risk/opportunity spectrum

- Mitigating risk

- Primary risks introduction – stabilized asset

- Triple Net (NNN) lease structure

- Full Service (FS) / Gross lease structure

- Vacancy and bankruptcy

- Illiquidity | natural disasters | pandemics

- Summary of risks

- Unstabilized asset

- Ground-up development risks – time and cost

- Market risks

- Environmental

- Construction delays and change orders

- Land price and timing

- International real estate investing risks part 1

- International real estate investing risks part 2

- Biggest risks of all

- Real estate cycles

- Challenges to reaching equilibrium

- Supply and demand

- CRE lags residential

- The last 3 office market crashes

- U.S. housing market

- Subprime history

- Global housing prices.

Module 3: Real Estate Finance and Investments in 80 Minutes

From this module, you will:

-

Get a basic conceptual foundation of commercial real estate finance and investments, on which you can build further later if you wish

-

Understand how mortgage lenders view capital exposure to operating property collateral

-

Grasp the life cycle of an equity investment and how equity players measure yield and returns

Details

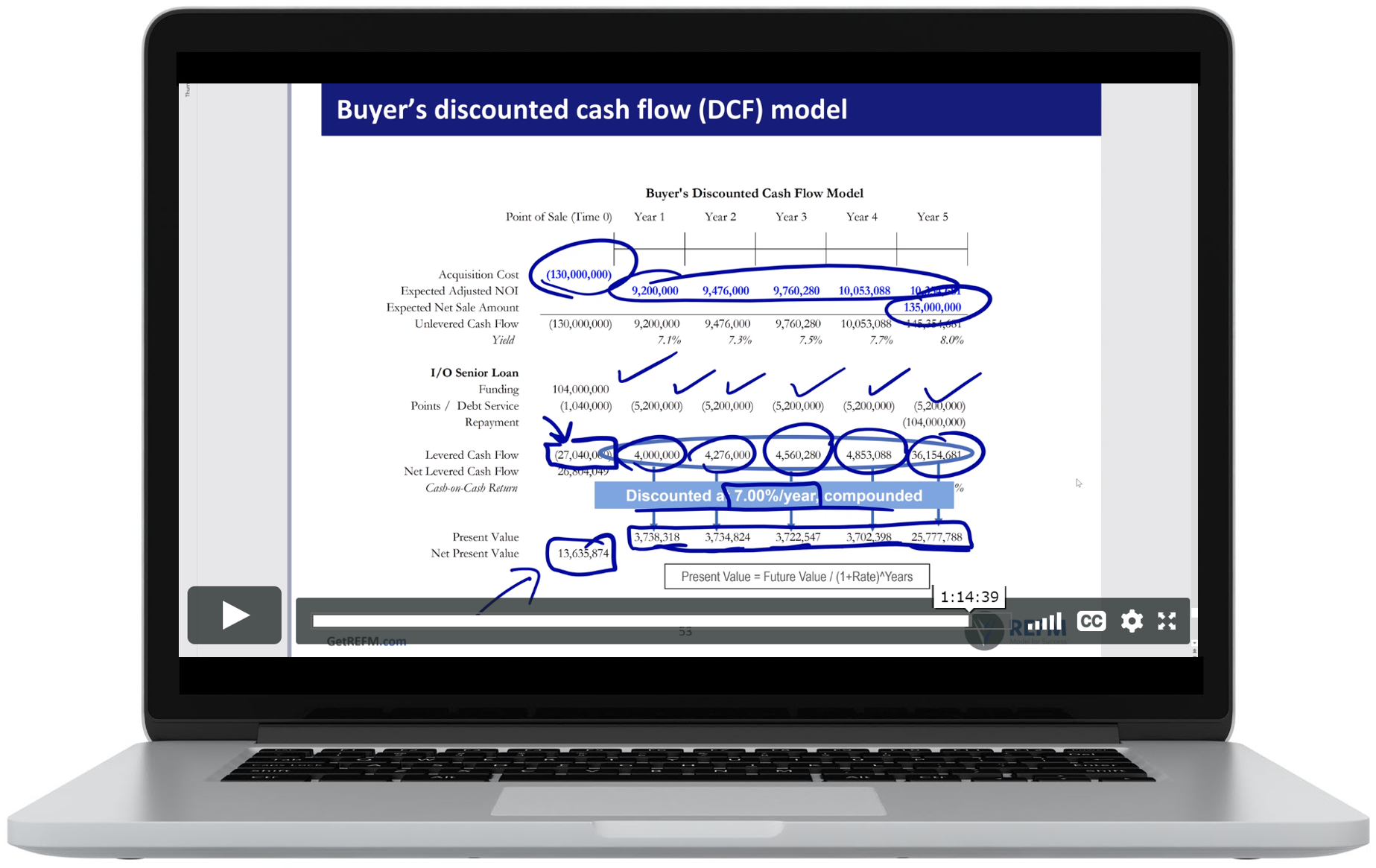

In this module, you will learn about debt financing, walk through an income-producing property cash flow set up, learn about investment yield and returns metrics and how to calculate them, and take a deeper look at the discounted cash flow model.

- How and why to use debt in a CRE transaction

- What determines how much debt you are offered, and how much you should use

- How senior and mezzanine lenders think, and how they make money

- The benefits of refinancing, and risk of a cash-out refinancing portfolio building plan

- How property owners think about pricing their properties for sale

- How property buyers rationalize their offer prices

- How equity players measure yield and return on their investments

This is a slide presentation course with an associated multiple choice quiz. You will watch the video and, if you choose, complete the quiz and review the answers given when the quiz is automatically graded.

The video running time is 80 minutes. Watching all the video (replaying parts where desired) and completing the quiz and reviewing the answers will take approximately 85 to 95 minutes, depending on the individual.

Upon successful completion of this module, you will:

- Have gained a holistic conceptual understanding of the use of debt in CRE transactions

- Have learned about how lenders and equity players think about the use of debt

- Have an appreciation for both the opportunities and risks that come with the use of debt.

Includes

Lifetime online access to:

- An easily-navigated 80-minute video tutorial with playback controls up to 2x speed. Videos have captions available and are playable on any device including PC, Mac, phones and tablets.

- PDF file of the 59 slides presented in the video

- 10-question quiz (multiple-choice, automatically graded) and answer key.